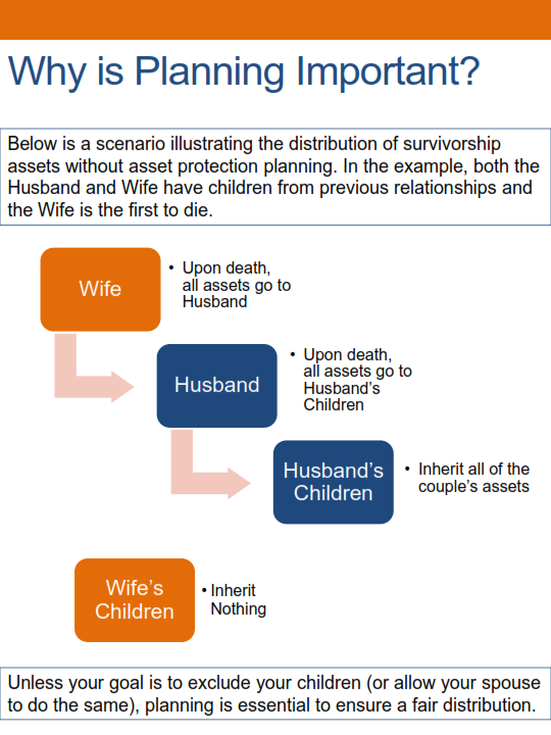

For those who play the lottery and are lucky enough to have their numbers hit, a procedure should be followed to protect the payout. The procedure limits the negative implications of winning and limits the likelihood of future bankruptcy. How do you claim lottery winnings? To avoid an avalanche of family members and friends hounding you for loans or gifts, the best way to claim lottery winnings is anonymously. To claim a prize anonymously, a “Blind Trust” is created to shield the identity of beneficiaries and only disclose the name of the Trustee. The Trustee for the Blind Trust then claims the prize for the benefit of the respective beneficiaries. If there were a pool of co-workers, friends, or family members who claim the prize, an entity (such as a partnership, LLC, or corporation) can be created to direct proceeds to each individual. This allows for structure in the distributions disproportionate allocations in the event one member of the pool is entitled to a larger or smaller share of the proceeds. Can I buy all of my friends and family gifts? Yes, but not before evaluating the tax considerations. Lottery winnings are taxed as ordinary income. While the lottery commission does withhold some taxes, there may be additional taxes due by April 15 of the following year; thus, it is best to hold off on spending until you determine how much the IRS will take. Additionally, there are gift tax implications for giving things away. If you decide, I want to buy a car for every member of my family; a gift tax return will need to be filed for every vehicle. To the extent you give away more than the lifetime gift tax exclusion amount, additional estate tax will be owed. -- Related article: Creating your Will and Trust - Estate Planning If someone walked up to me today and handed me a check for $300,000 I would do many things with that money, after of course I finished the lengthy and awkwardly affectionate hug I would give that person. After paying off some high-interest debt I would look to the future, which would include starting an account for my one-year-old daughter's future college plans. My wife mentioned starting a large wedding fund, but I told her it is unlikely that my daughter will ever get married because I’m not going to let her talk to any boys after she turns 5. With all of the future planning that would take place in this scenario, I had to consider another important, though somber, scenario. What if my wife and I are not around anymore? What happens to these plans? This is where Elliott's guidance was helpful. I learned that even if I had life insurance to cover the difference, what happens to this money is a sobering reality. The reality is that at the age of 18 my daughter would receive all of these assets, including the aforementioned check for $300,000. If I received a check for $300,000 at the age of 18, I would currently own the original animatronic T-Rex from the movie Jurassic Park. While I still think this would be a really cool conversation piece in our living room, I now believe paying for education, healthcare, and other life essentials is much more important. The alternative to trusting a teenager with hundreds of thousands of dollars is to create a Revocable Living Trust. This Trust will only distribute assets for the essentials in life, including education, healthcare and support, until the child reaches a more mature age. Another benefit of this Trust is the option to designate a guardian for a child in a Will, and a separate trustee to handle the money. This way if you have someone who would be great at raising kids but might try to buy the original animatronic Jurassic Park T-rex with the money, it is possible to split up these duties. The sad reality is that nobody has given me a check for $300,000 yet. The good news is that with my current assets, life insurance and Revocable Living Trust, I know my daughter will be taken care of in a responsible and loving way no matter what the future has in store for me. If you have any questions on the information contained in this blog, see the estate planning website of Cincinnati attorney, Elliott Stapleton, with CMRK Law, 123 Boggs Lane, Cincinnati, Ohio 45246, or contact him at (513) 334-0099. For blended families, it is especially important to proactively plan to protect your children and spouse.

This article explains why planning is necessary and solutions to ensure a fair outcome. http://www.ohio-estate-planning.com/asset-protection-for-blended-families.html  For business owners in Ohio, it is important to create a Trust. By establishing a Revocable Living Trust during your life, if you become disabled or deceased the Trustee appointed will be able to immediately take control of your company. If you only have a Will, there could be weeks of delay before your Executor is appointed by the Probate Court. This delay can result in employees not being paid on time and other missed deadlines. Here are four more advantages to using a Trust as opposed to just a Will along with a link to an article discussing each in more detail: |

Elliott Stapleton Attorney with CMRS Law

|

RSS Feed

RSS Feed