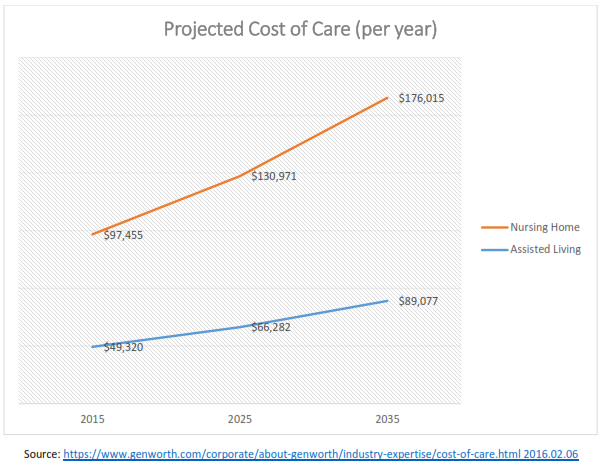

By: Elliott Stapleton Estate Planning Attorney in Cincinnati, Ohio It’s not always easy to consider the possibility that you, your spouse, or your parents will become disabled and require a nursing home. Without considering this possibility, your family has a significant financial blind spot. As of 2016, for Assisted Living Facilities the annual cost is $49,320 per year. The current cost for a private room in a nursing home is, on average, $97,455 per year.* If your family is not close to dealing with nursing home care today, you can see the projected rates for the years 2025 and 2035 increase significantly: There is good news. With proactive elder law and disability planning, you can limit the risk of all assets being lost to nursing home expenses. Elder law and disability planning is in addition to a general estate planning discussion. For example, creating a Revocable Living Trust will help you avoid probate and limit creditors after death, but does not address Medicaid considerations. In most cases, this type of planning includes a meeting with the parents and adult children. A group meeting can be productive to ensure all members of the family understand the goals and path to achieve those goals. It is important to be proactive with elder law planning. Your planning options diminish as you get closer to going into a nursing home. If you and your family are proactive, elder law and disability planning is an area where we can give you comfort in knowing that, if you or your loved ones becomes disabled, you will be prepared. If you have questions, feel free to contact us and schedule an initial consultation related to elder law and disability estate planning. Elliott Stapleton Attorney with CMRS Law 123 Boggs Lane, 1st floor, Cincinnati, Ohio 45246 Phone: 513-334-0099 *Source Genworth.com Cincinnati, Ohio; visited on 2016.02.06

0 Comments

I just saw a video of a man who received an entire face transplant from an anonymous organ donor. As a nurse I am familiar with skin being considered an organ, but it had not occurred to me that someone could be walking around with my face after I die. I asked my lawyer, Elliott Stapleton, if I could stipulate somewhere in my Estate Plan that only a person with a lot of muscles be given my face when I die so that my wife could finally see what that looks like. After the long silence Elliott decided we should review some of the other benefits of having an Estate Plan.

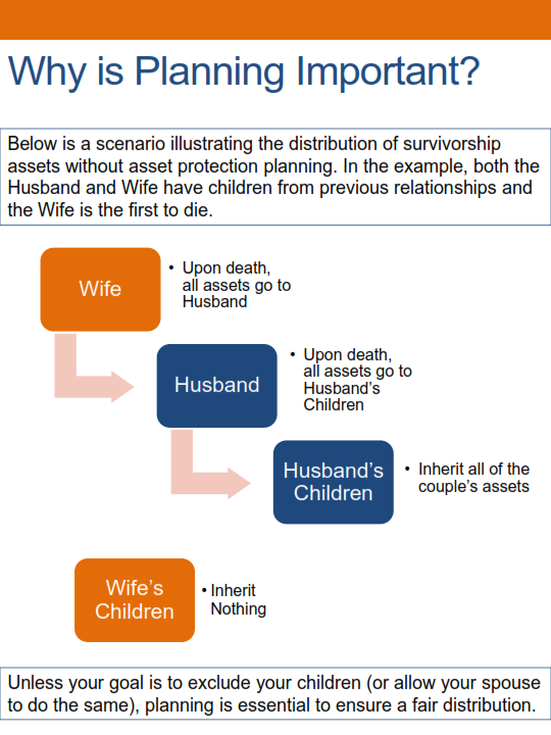

An Estate Plan is a plan that puts all of a person’s affairs in order should they pass away or become incapacitated. It draws a very specific map for the survivors to follow in regards to financial assets, medical decisions, beneficiary designation, and much more! Or in my case, my beneficiaries will receive an actual treasure map, whereby they must go on an Indiana Jones-style treasure hunt, with boulders and poison-tipped darts. One benefit of an Estate Plan is the ability to create a Will, which allows for designation of Beneficiaries and Guardians (the people who will take care of your children if you die.) I still have not heard back from Oprah Winfrey, which brings me to the point that the Guardian(s) you select should be aware and willing to take your children (which is why I sent Oprah a letter in the first place.) Another benefit to an Estate Plan is the ability to create a Trust. Putting your assets through probate court eats away at your money and delays payment to your beneficiaries by months and sometimes even years! A Trust allows you to avoid probate court, saving your estate lots of money and time. More importantly though, it designates a Trustee to distribute your assets according to your wishes. The Trustee cannot, however, stop the beneficiaries from throwing away your vintage “We Are the World” vinyl once it is left to them. You can also designate a Financial Power-of-Attorney to make any financial decisions if you become incapacitated. I’ve discussed this in a previous article, but in summary no one has ever asked me to be a Financial Power-of-Attorney because I aspire to someday have my own expensive Jim Henson-type creature lab. Another benefit of an Estate plan is the ability to create a Healthcare Power-of-Attorney. This names a person who will make all of the medical decisions if you are unable to do so. I tried to make my oldest brother my Healthcare Power-of-Attorney halfway through my 21st birthday party, but I’m pretty sure the bar napkin I wrote it on wouldn’t have stood up in court. Elliott explained that a Living Will can also be created to declare personal preferences on life support and other treatments. I declared that if I’m ever incapacitated, someone is to give me daily foot massages. Elliott said that this would be up to my family and close friends to carry out, but would not be enforceable by law. The final benefit of an Estate Plan I will discuss is the ability to create a Personal Record Book. As a humorist blogger and inventor, if I were to pass away I would want my wife to have access to all of my Good Ideas I’ve had over the years. With a Personal Record Book I can leave her my passwords and grant her access to things like my Facebook page, my blog, and my monthly subscription to Muscle magazine (which I don’t own yet.) Another added benefit of this part of the Estates Plan is that I am able to declare whether I want to be buried, cremated, or in my case have my ashes spread on the salad bar at Frisch’s that I love so much. I am in no way a controlling person, but the thought of having no control over things like my money, health, and Facebook page if I become incapacitated or die is terrifying to me. Even more terrifying than the thought of some other overweight person having my face. If you have any questions on the information contained in this blog, see the estate planning website of Cincinnati attorney, Elliott Stapleton, with CMRS Law, 123 Boggs Lane, Cincinnati, Ohio 45246, or contact him at (513) 334-0099. If someone walked up to me today and handed me a check for $300,000 I would do many things with that money, after of course I finished the lengthy and awkwardly affectionate hug I would give that person. After paying off some high-interest debt I would look to the future, which would include starting an account for my one-year-old daughter's future college plans. My wife mentioned starting a large wedding fund, but I told her it is unlikely that my daughter will ever get married because I’m not going to let her talk to any boys after she turns 5. With all of the future planning that would take place in this scenario, I had to consider another important, though somber, scenario. What if my wife and I are not around anymore? What happens to these plans? This is where Elliott's guidance was helpful. I learned that even if I had life insurance to cover the difference, what happens to this money is a sobering reality. The reality is that at the age of 18 my daughter would receive all of these assets, including the aforementioned check for $300,000. If I received a check for $300,000 at the age of 18, I would currently own the original animatronic T-Rex from the movie Jurassic Park. While I still think this would be a really cool conversation piece in our living room, I now believe paying for education, healthcare, and other life essentials is much more important. The alternative to trusting a teenager with hundreds of thousands of dollars is to create a Revocable Living Trust. This Trust will only distribute assets for the essentials in life, including education, healthcare and support, until the child reaches a more mature age. Another benefit of this Trust is the option to designate a guardian for a child in a Will, and a separate trustee to handle the money. This way if you have someone who would be great at raising kids but might try to buy the original animatronic Jurassic Park T-rex with the money, it is possible to split up these duties. The sad reality is that nobody has given me a check for $300,000 yet. The good news is that with my current assets, life insurance and Revocable Living Trust, I know my daughter will be taken care of in a responsible and loving way no matter what the future has in store for me. If you have any questions on the information contained in this blog, see the estate planning website of Cincinnati attorney, Elliott Stapleton, with CMRK Law, 123 Boggs Lane, Cincinnati, Ohio 45246, or contact him at (513) 334-0099. For blended families, it is especially important to proactively plan to protect your children and spouse.

This article explains why planning is necessary and solutions to ensure a fair outcome. http://www.ohio-estate-planning.com/asset-protection-for-blended-families.html For every parent, picking a Guardian is an important and necessary decision. Here is a video that provides guidance: Taking a Vacation without the Kids? Have you Appointed a Person to Authorize Medical Treatment?6/13/2014

Why is this Important? Have you planned a getaway for just the "grown-ups"? If you are arranging a trip and leaving your children with grandparents or a family friend, have you considered what authority the caregiver will have in a medical emergency? What is the Solution? If you leave your children (or are a person taking care of the children), it is necessary to have a Temporary Authorization to Approve Medical Treatment signed by both parents. Putting this Temporary Authorization in place will save parents from cutting their vacation short over an ear infection or a sore throat. More importantly, this Temporary Authorization will ensure the person you put in charge can do everything needed to protect your children. How can you Create this Authorization? Typically this authorization would be created by your Attorney to ensure you understand the limitations on the Caregiver's authority. In addition, it is a good idea to ensure your Will, Power of Attorney, and Estate Plan are up-to-date before taking your trip. How long does it take to update or create a Will and Estate Plan? After the initial free consultation, it typically takes 2-4 weeks. It is possible to expedite if you have an upcoming vacation or short timeline. In the initial consultation, we will discuss your goals, options for achieving those goals, and the flat rate for services.  Many people avoid Estate Planning because it may be uncomfortable or seem too morbid to discuss. But the cost and stress associated with a lack of planning results in a net loss for any family; regardless of your net worth. This article offers important information about the benefits of avoiding probate in the State of Ohio. These benefits include reduced attorneys' fees, less time for administration, and creditor protection for the next generation. |

Elliott Stapleton Attorney with CMRS Law

|

Elliott Stapleton - Cincinnati Estate Planning Attorney | 123 Boggs Lane, 1st floor, Cincinnati, Ohio 45246 | Phone: 513-334-0099

THIS IS A LEGAL ADVERTISEMENT ONLY. GENERAL INFORMATION ONLY, NOT TO BE CONSTRUED AS LEGAL ADVICE. ALL LEGAL DECISIONS SHOULD BE ADDRESSED WITH LEGAL COUNSEL

© Copyright Elliott Stapleton, LLC. All rights reserved.

The content on this site is for information purposes only.

No one should rely on the internet, including this or any other website, for legal advice.

Communicating through this site does not create an attorney client relationship and your submission is not a confidential communication.

THIS IS A LEGAL ADVERTISEMENT ONLY. GENERAL INFORMATION ONLY, NOT TO BE CONSTRUED AS LEGAL ADVICE. ALL LEGAL DECISIONS SHOULD BE ADDRESSED WITH LEGAL COUNSEL

© Copyright Elliott Stapleton, LLC. All rights reserved.

The content on this site is for information purposes only.

No one should rely on the internet, including this or any other website, for legal advice.

Communicating through this site does not create an attorney client relationship and your submission is not a confidential communication.

RSS Feed

RSS Feed