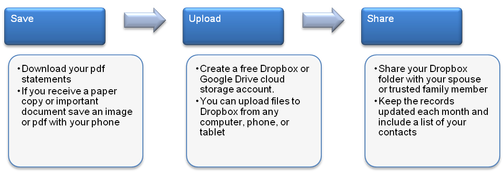

What would happen if your spouse didn't come home from work today? Would you know where to find all of the important documents and records for their responsibilities in the home? Even if your spouse is just temporarily unable to handle their usual share, the stress associated with these circumstances is exacerbated by the frustration of trying to find basic information. Does your spouse normally handle items such as when your car insurance is due or how many itemized deductions should be taken this year, or do you both track this information? Chances are, the answer is no. While it may not be the most pleasant topic to think about, there is a solution that will give you peace of mind, help alleviate those concerns, and best of all, it is free. To solve this problem, create a shared Dropbox or Google Drive cloud storage folder for all of your important files. For most families, there is one person who handles bill payments, children's records, legal documents, taxes, or insurance. With the "green" paperless movement, hardcopy statements and records are becoming the exception rather than the rule. Do you remember the last time you received a checking account statement in the mail? You can now download your email statements or snap a picture with your phone (there are easy to use scanner applications for your phone such as TurboScan which converts these images to PDF format). Once you have the files, create a Dropbox or Google Drive account. Both offer free accounts with enough space to handle thousands of images or PDF's. After you have created an account you can upload the files from your computer, phone, or tablet. Even if you lose your computer, phone or tablet, the files are still stored in the cloud and will allow you to access the information from almost any device with an internet connection. After you have created a Dropbox or Google Drive account, you can share your "house folder" with your spouse or trusted family member. If either of you saves a file in the shared folder, that file will be accessible to the other. You can also create a master contact list, which would include account information, regular payment dates, and a snapshot of important details. What are some other benefits? Have you ever needed a document that you just could not find in your file or left at home? Another added benefit of creating a shared house folder is the elimination of paper files. Now, whenever or wherever you need the file, it is right there on your phone. Have you ever needed to send or receive a large file that wouldn't fit on an e-mail? You can create a separate folder in Dropbox and share it with the other person. The benefits to creating such an account are endless. Everyone has access to all information needed whenever, wherever, and best of all, it costs nothing.  For business owners in Ohio, it is important to create a Trust. By establishing a Revocable Living Trust during your life, if you become disabled or deceased the Trustee appointed will be able to immediately take control of your company. If you only have a Will, there could be weeks of delay before your Executor is appointed by the Probate Court. This delay can result in employees not being paid on time and other missed deadlines. Here are four more advantages to using a Trust as opposed to just a Will along with a link to an article discussing each in more detail: _ Small Business Owners should be aware of the current Estate Tax Credits for 2012 and changes that take effect in 2013. These will have a drastic impact on succession planning for Ohio small businesses.

Federal Estate Tax Currently, the Federal Estate Tax credit is equivalent to $5,120,000.00 per person (any dollar under $5,120,000.00 passes free of Federal Estate Tax. Married couples are able to transfer their unused Federal Estate Tax credit to the surviving spouse that provides the equivalent of a $10,240,000.00 per couple credit (also known as “Portability”). Unless the President and Congress can agree on an extension of the current law, the Federal Estate Tax credit will be reduced, beginning in 2013, to $1,000,000.00 per person, without Portability, at a rate of 55%. Ohio Estate Tax In 2012, the Ohio Estate tax rate is 6% of every dollar between $338,333.33 and $500,000.00. For every dollar above $500,000.00, the tax rate is 7%. This calculation does not include life insurance proceeds. Effective in 2013, the Ohio Estate tax has been repealed. This will be a substantial savings for residents of Ohio. Before transferring your residence to another state, it is important to check that state’s law regarding Estate Taxes. |

Elliott Stapleton Attorney with CMRS Law

|

RSS Feed

RSS Feed