|

From time to time when I meet wonderful people in my life, I find myself telling them I’d hire them if I owned a business. To me this is a great compliment because owning a business is very personal, so inviting someone into that company is saying a lot about how you feel about them. Kind of like when I meet terrible people, I tell them I’d fire them out of a cannon into the sun. Hiring the right people for a business is obviously so important. But it is equally important to take steps to protect your business should the relationship with an employee turn into something reminiscent of an episode of Judge Judy or even Maury Povich. The following are some points to consider that will protect you when adding employees to your small business.

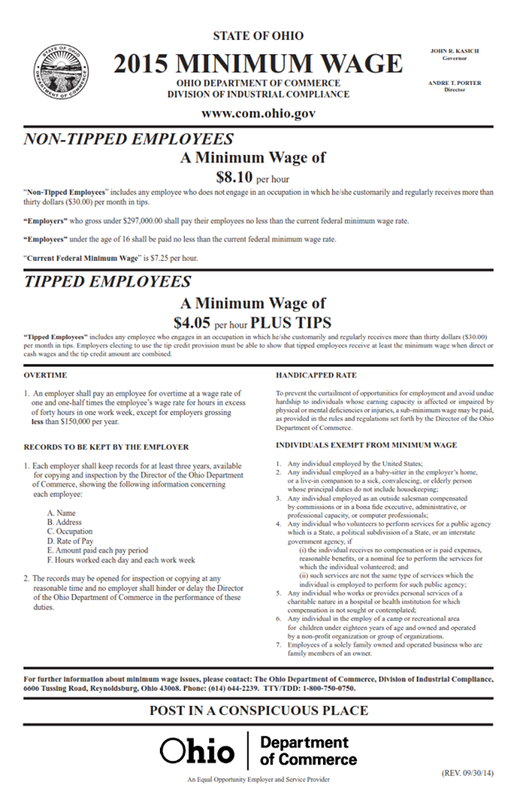

First, it is important to determine who is an employee and who is an independent contractor based on the IRS guidelines (See IRS form SS-8). There are a lot of differences between an employee and independent contractor (beyond who gets to attend the company Christmas party). Figure out which relationship works best for your company by differentiating the two roles. Second, draft an Employee Handbook to establish policies to minimize risk of wrongful termination and discrimination claims. For example, dress codes are a great way to ensure you are sending a clear message that yoga pants are not appropriate for anyone with facial hair. The third way to protect your company is to post the required employee disclosures at the office. Anything from health and safety postings to minimum wage postings can be required. It is important to figure out what is required of your business so employees know their rights if they wish to report a health or safety issue. For example, as a NICU nurse I learned from my lawyer, Elliott Stapleton, that dirty diapers are not considered a safety violation. Agree to disagree. A business must protect its assets, which include its people and trade secrets. This is why it is important to create documents such as non-compete and non-solicitation agreements for key employees to make sure other companies don’t steal all of your talent and ideas. I’m sure this is why no one from McDonald’s has left the company to join up with a former Pizza Hut employee in order to create a Big Mac Pizza store, which I think would be delicious. Hiring the right employees is paramount to running a business. But the aforementioned points are almost as important to keeping your business safe and intact. There is enough to worry about when running a business. Having a lawyer like Elliott Stapleton on your team makes this process so easy you can spend your valuable time deciding who to hire and who to fire (out of a cannon into the sun.)

0 Comments

I was told my great-grandfather was a shrewd businessman. He was self-employed and worked hard until the day he died. Then again, if he would have purchased the correct franchise he wouldn’t have needed to work hard until the day he died. When a gentleman asked him to buy some McDonald’s franchises for $4,000 each, he turned him down. Instead he decided his neighborhood needed more Pizza Kings. I’m not knocking Pizza King (I had never heard of it until my dad told me this story,) but all I am saying is today McDonald’s has 58 million likes on Facebook and Pizza King has 37,000.

Either way because my great-grandfather didn’t leave me millions, I have to work hard to make a living. I do not complain because if I was a multi-millionaire I’d probably weigh 1000 pounds from lying around on piles of money all day eating free Big Mac sandwiches. But the thought often crosses my mind to follow in my great-grandfather’s entrepreneurial footsteps, hoping of course that in many years the franchise I choose will have millions of likes on Facebook, and not thousands.

For me, the appeal of purchasing a franchise is that unlike a new startup, the business plan/formula is already in place for you. With built-in franchise support and pre-existing name recognition that supplies you with loyal customers before you even lift a finger, purchasing a franchise can be a great option for someone who believes they will be successful as a business owner but doesn’t want to take the risks involved with a new startup. There is still hard work to be done, but it is nice to be in control (without taking on unnecessary risks.) My friend and I were recently considering the purchase of a particular franchise that we believe would do very well in our area. Currently I have to drive way too far to obtain this particular food, and they don’t deliver to my neighborhood. My wife says we shouldn’t purchase a franchise so that I can get my favorite food delivered to me. While she thinks that would be lazy, I think our willingness to pay tens of thousands of dollars for delivery of this food is proof that the business would be successful. I am concerned, however, that my friend and I would potentially eat all of our profits (like literally eat so much food we wouldn’t profit) which I imagine isn’t a good business practice. No matter what franchise you end up with, the chance of success grows exponentially when you have a great attorney representing you throughout the process. The ability to work through a franchise contract, with its hundreds of pages of legalese, is just one example where a great attorney can put you in a better position with those selling the franchise. I picture my attorney, Elliott Stapleton, sitting at a table across from the “corporate types” working out a great deal for me as I lean back in my chair and eat my favorite food (that I now own.) I’m sure my great-grandfather would be proud. Every Limited Liability Company should have an Operating Agreement. This Agreement establishes the rules in which the owners of an LLC will conduct business.

Without an operating agreement, it is unclear to the members what rules they must abide by when conducting business, distributing profits, and voting on important ownership matters. This also allows the business to establish voting rights, creditor protections, and standards to resolve disputes among the members.  Many retirees want to use their knowledge and experience after retirement, but on their own terms. This can be accomplished by acting as a consultant for either individuals or companies. In some cases, the company you retired from would still like access to your expertise. How do I protect my personal assets? If you are considering the investment of time, energy, and money that goes into a new business, it is important to take the proper steps to protect your investment and to protect the personal assets you have worked your entire life to earn. For consultant companies, this protection can be provided by forming an Ohio LLC. What is LLC? LLC stands for Limited Liability Company and indicates how liability is limited to the assets of the business. Ohio business law allows owners to insulate their personal assets from the assets of a business. For all new businesses, I offer a free initial consultation. In that meeting, we will discuss your goals and the steps that must be taken to achieve those goals. In the first meeting, we will also discuss the fixed fees for services. To get started, feel free to contact my office and schedule an appointment. Here is a link to download an Ohio Business Checklist. When starting a business with a unique idea, it is important to limit your disclosure of this idea to those who have signed a non-disclosure agreement (NDA).

The purpose of an NDA is to restrict the type of disclosure a party can make after you provide them with important information about your idea or concept. Once information is no longer confidential, it can be used by anyone to compete with your company before you have a chance to establish your brand identity. (See post on Trade Secrets). Without an NDA in place, a business owner could lose its competitive advantage. _ Small Business Owners should be aware of the current Estate Tax Credits for 2012 and changes that take effect in 2013. These will have a drastic impact on succession planning for Ohio small businesses.

Federal Estate Tax Currently, the Federal Estate Tax credit is equivalent to $5,120,000.00 per person (any dollar under $5,120,000.00 passes free of Federal Estate Tax. Married couples are able to transfer their unused Federal Estate Tax credit to the surviving spouse that provides the equivalent of a $10,240,000.00 per couple credit (also known as “Portability”). Unless the President and Congress can agree on an extension of the current law, the Federal Estate Tax credit will be reduced, beginning in 2013, to $1,000,000.00 per person, without Portability, at a rate of 55%. Ohio Estate Tax In 2012, the Ohio Estate tax rate is 6% of every dollar between $338,333.33 and $500,000.00. For every dollar above $500,000.00, the tax rate is 7%. This calculation does not include life insurance proceeds. Effective in 2013, the Ohio Estate tax has been repealed. This will be a substantial savings for residents of Ohio. Before transferring your residence to another state, it is important to check that state’s law regarding Estate Taxes. _ An individual, start-up business, or established company may have an idea or concept that is unique but not otherwise protectable by a patent. This can include a business model, formulas, recipes, processes, product concepts, marketing plans, unique sources for supplies, assembly processes, or customer lists (collectively referred to as “trade secrets”).

The protection of your trade secrets is essential to maintaining a competitive advantage. How can a start-up business protect its Trade Secrets? As the name suggests, the subject of a trade secret must remain secret and there must be adequate measures to protect the secrecy. That means it must not be public knowledge or of general knowledge in the trade or industry. If the secret is disclosed through authorized means or there are not adequate measures to guard the secrecy competitors can take advantage of the trade secret. But if there is an unauthorized disclosure and use of a trade secret, there are strict criminal and civil penalties. (Note: If you are an employee, it is important not to disclose a trade secret, here is a summary of the criminal risk) What are adequate measures for protecting a Trade Secret? While there are no fixed rules as to what are “adequate” measures, there are best practices that must always be followed: 1. Never disclose confidential information, to anyone who has not signed a nondisclosure agreement or without a confidential relationship. 2. Have password protection on all software that contains Trade secrets and limit an employee or contractor’s ability to place the trade secrets on a personal computer. 3. Maintain a policy that all business records must be returned after separation with an employee or contractor. 4. Never disclose any aspect of the trade secret publicly. The best practice to ensure your trade secrets are protected is to conduct an annual audit. Through this process, you can identify your trade secrets, determine the steps that can be taken to protect their secrecy, update your company passwords, and test your security measures. _ Yes, generally there are two categories a Power of Attorney will fall into: A Power of Attorney for Financial Decisions and Health Care Power of Attorney.

A Power of Attorney for Financial Decisions can be as broad or as limited as you prefer, even limited to a particular date or purpose. This power can become effective immediately after signing or only become effective if you are disabled/incompetent. For small business owners, it is especially important to have a Power of Attorney reserved for a trusted co-owner or family member. A Healthcare Power of Attorney grants authority to make medical decisions if you are in a coma or become mentally incapacitated. Within the Medical Power will be specific guidance as to what your wishes were before becoming incompetent. Without these protective measure, there could be a devastating lapse in time where the business cannot operate should something happen to you. _ At some point, every employer will have to terminate an employee. To avoid claims that the termination was based on discrimination or was without just cause there is a clear procedure that should be followed to avoid future, unnecessary costs and attorney’s fees.

How do you limit potential discrimination claims? You can discharge an employee at any time for any reason, except for prohibited reasons. Generally, those prohibited reasons are: Religion, Gender (including pregnancy), Age, Race, Political beliefs, National origin, Disability, Retaliation for an otherwise legal act such as: asserting overtime rights, reporting that the employer is breaking the law (“Whistle Blowing”), or making a worker’s compensation claim There is no way to see inside of an employer’s mind to determine why he or she fired an employee, the evaluation is by actions and the result of those actions. To ensure your true reasons for firing an employee are clear, it is important to document all reprimands and maintain an Employee Handbook. |

Elliott Stapleton Attorney with CMRS Law

|

RSS Feed

RSS Feed