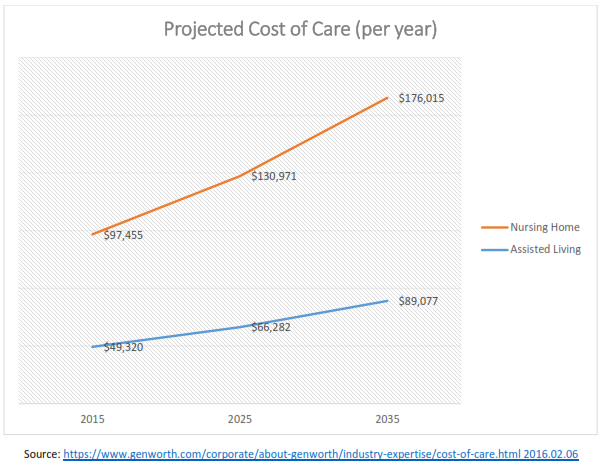

Protect your family's nest egg Protect your family's nest egg Have you considered the possibility that you, your spouse, or your parents will become disabled and require a long term care facility? Without considering this possibility, your family may have a significant financial blind spot. The current cost for a private room in a long term care facility is, on average, $97,455 per year (about $8,121 per month). There is good news. With proactive planning, you can limit the risk of all your assets being lost to long term care expenses. To learn more, join me for a live webinar on Protecting Your Assets from being devoured by long term care expenses. You can join our session by using a Mac, PC or a mobile device. After registering, you will receive a confirmation email containing information about joining the webinar. Join us for a webinar on May 10, 2016 at 8:00 PM EDT. This webinar will be hosted by OPTetech. View System Requirements

0 Comments

By: Elliott Stapleton Estate Planning Attorney in Cincinnati, Ohio It’s not always easy to consider the possibility that you, your spouse, or your parents will become disabled and require a nursing home. Without considering this possibility, your family has a significant financial blind spot. As of 2016, for Assisted Living Facilities the annual cost is $49,320 per year. The current cost for a private room in a nursing home is, on average, $97,455 per year.* If your family is not close to dealing with nursing home care today, you can see the projected rates for the years 2025 and 2035 increase significantly: There is good news. With proactive elder law and disability planning, you can limit the risk of all assets being lost to nursing home expenses. Elder law and disability planning is in addition to a general estate planning discussion. For example, creating a Revocable Living Trust will help you avoid probate and limit creditors after death, but does not address Medicaid considerations. In most cases, this type of planning includes a meeting with the parents and adult children. A group meeting can be productive to ensure all members of the family understand the goals and path to achieve those goals. It is important to be proactive with elder law planning. Your planning options diminish as you get closer to going into a nursing home. If you and your family are proactive, elder law and disability planning is an area where we can give you comfort in knowing that, if you or your loved ones becomes disabled, you will be prepared. If you have questions, feel free to contact us and schedule an initial consultation related to elder law and disability estate planning. Elliott Stapleton Attorney with CMRS Law 123 Boggs Lane, 1st floor, Cincinnati, Ohio 45246 Phone: 513-334-0099 *Source Genworth.com Cincinnati, Ohio; visited on 2016.02.06  For those who play the lottery and are lucky enough to have their numbers hit, a procedure should be followed to protect the payout. The procedure limits the negative implications of winning and limits the likelihood of future bankruptcy. How do you claim lottery winnings? To avoid an avalanche of family members and friends hounding you for loans or gifts, the best way to claim lottery winnings is anonymously. To claim a prize anonymously, a “Blind Trust” is created to shield the identity of beneficiaries and only disclose the name of the Trustee. The Trustee for the Blind Trust then claims the prize for the benefit of the respective beneficiaries. If there were a pool of co-workers, friends, or family members who claim the prize, an entity (such as a partnership, LLC, or corporation) can be created to direct proceeds to each individual. This allows for structure in the distributions disproportionate allocations in the event one member of the pool is entitled to a larger or smaller share of the proceeds. Can I buy all of my friends and family gifts? Yes, but not before evaluating the tax considerations. Lottery winnings are taxed as ordinary income. While the lottery commission does withhold some taxes, there may be additional taxes due by April 15 of the following year; thus, it is best to hold off on spending until you determine how much the IRS will take. Additionally, there are gift tax implications for giving things away. If you decide, I want to buy a car for every member of my family; a gift tax return will need to be filed for every vehicle. To the extent you give away more than the lifetime gift tax exclusion amount, additional estate tax will be owed. -- Related article: Creating your Will and Trust - Estate Planning From time to time when I meet wonderful people in my life, I find myself telling them I’d hire them if I owned a business. To me this is a great compliment because owning a business is very personal, so inviting someone into that company is saying a lot about how you feel about them. Kind of like when I meet terrible people, I tell them I’d fire them out of a cannon into the sun. Hiring the right people for a business is obviously so important. But it is equally important to take steps to protect your business should the relationship with an employee turn into something reminiscent of an episode of Judge Judy or even Maury Povich. The following are some points to consider that will protect you when adding employees to your small business.

First, it is important to determine who is an employee and who is an independent contractor based on the IRS guidelines (See IRS form SS-8). There are a lot of differences between an employee and independent contractor (beyond who gets to attend the company Christmas party). Figure out which relationship works best for your company by differentiating the two roles. Second, draft an Employee Handbook to establish policies to minimize risk of wrongful termination and discrimination claims. For example, dress codes are a great way to ensure you are sending a clear message that yoga pants are not appropriate for anyone with facial hair. The third way to protect your company is to post the required employee disclosures at the office. Anything from health and safety postings to minimum wage postings can be required. It is important to figure out what is required of your business so employees know their rights if they wish to report a health or safety issue. For example, as a NICU nurse I learned from my lawyer, Elliott Stapleton, that dirty diapers are not considered a safety violation. Agree to disagree. A business must protect its assets, which include its people and trade secrets. This is why it is important to create documents such as non-compete and non-solicitation agreements for key employees to make sure other companies don’t steal all of your talent and ideas. I’m sure this is why no one from McDonald’s has left the company to join up with a former Pizza Hut employee in order to create a Big Mac Pizza store, which I think would be delicious. Hiring the right employees is paramount to running a business. But the aforementioned points are almost as important to keeping your business safe and intact. There is enough to worry about when running a business. Having a lawyer like Elliott Stapleton on your team makes this process so easy you can spend your valuable time deciding who to hire and who to fire (out of a cannon into the sun.) Many people fail to recognize estate planning as an important step in securing their family's financial future and well-being. What Elliott Stapleton, an experienced estate planning attorney, has discovered is by simply educating people he can start them on the path to overall security and peace of mind. In his webinar, available for free between October 26th-November 1st, Elliott introduces the viewer to each portion of the estate planning process. Simply register below to receive the link to view the free webinar. Also, feel free to contact Elliott Stapleton directly for a completely free estate planning consultation. I love to eat food. Even people who don’t know me can tell I love to eat food. Living in Cincinnati there are a lot of great foods that I have eaten since I was a child. When I was a poor, recent college graduate I could not afford to eat at the restaurants I loved, so I tried my very best to copy these meals for much cheaper at home.

The problem was I could never quite get there; my Skyline cheese was too hard and the canned chili never tasted the same. My wanna-be Montgomery Inn ribs were chewy even though the sauce from the bottle was still delicious. And trying to make Graeter’s Ice Cream out of cream and sugar left me with a messy kitchen and a pile of inedible creamy sugar. My point is sometimes spending the money makes a world of difference. This can be true when it comes to selling your house by owner. In many cases, spending the money for the expertise of a realtor can lead to a much less stressful and much more successful home sale. A good realtor can be like the delicious one-of-a-kind cheese on a Skyline Chili coney. However, for the person who is brave enough to tackle a home sale by owner, here are a few ideas on how to make it work. First and foremost is the decision on pricing. Researching your neighborhood sales, and understanding current market trends will allow you to reach a price point that won’t undermine your efforts right off the bat. I have always been tempted to put our house on the market for 5 million dollars so that a rich person’s curiosity would be peaked about what could possibly be in the house that was worth so much. Then when the really curious rich people do their walk through, I would have a really fancy, antique chest with a lock on it that says “do not open until home purchase.” I bet that would get them to buy. That leads me to my next point, which is the importance of marketing your home. The prominence of social media has not just allowed people to see pictures of each other on vacation, but it can also be used to spread the word on your home sale. That being said, realtors have the advantage in this area because of connections with other realtors, buyers, etc. Lastly, a major deterrent for people in the for sale by owner process tends to be the large amount of legal paperwork, including the real estate purchase agreement, involved in selling a house. However with the use of an experienced lawyer, it is possible to reduce the cost of the sales transaction if you already have a buyer or believe that it will not be necessary to market your home to secure a person to purchase. Ultimately the amount of effort you put into the for sale by owner process correlates with the success of the venture. And this doesn’t mean you have to go it alone. I have full confidence that paying Elliott Stapleton to help me sell my house would end well, especially if he brought Skyline chili for everyone. I was told my great-grandfather was a shrewd businessman. He was self-employed and worked hard until the day he died. Then again, if he would have purchased the correct franchise he wouldn’t have needed to work hard until the day he died. When a gentleman asked him to buy some McDonald’s franchises for $4,000 each, he turned him down. Instead he decided his neighborhood needed more Pizza Kings. I’m not knocking Pizza King (I had never heard of it until my dad told me this story,) but all I am saying is today McDonald’s has 58 million likes on Facebook and Pizza King has 37,000.

Either way because my great-grandfather didn’t leave me millions, I have to work hard to make a living. I do not complain because if I was a multi-millionaire I’d probably weigh 1000 pounds from lying around on piles of money all day eating free Big Mac sandwiches. But the thought often crosses my mind to follow in my great-grandfather’s entrepreneurial footsteps, hoping of course that in many years the franchise I choose will have millions of likes on Facebook, and not thousands.

For me, the appeal of purchasing a franchise is that unlike a new startup, the business plan/formula is already in place for you. With built-in franchise support and pre-existing name recognition that supplies you with loyal customers before you even lift a finger, purchasing a franchise can be a great option for someone who believes they will be successful as a business owner but doesn’t want to take the risks involved with a new startup. There is still hard work to be done, but it is nice to be in control (without taking on unnecessary risks.) My friend and I were recently considering the purchase of a particular franchise that we believe would do very well in our area. Currently I have to drive way too far to obtain this particular food, and they don’t deliver to my neighborhood. My wife says we shouldn’t purchase a franchise so that I can get my favorite food delivered to me. While she thinks that would be lazy, I think our willingness to pay tens of thousands of dollars for delivery of this food is proof that the business would be successful. I am concerned, however, that my friend and I would potentially eat all of our profits (like literally eat so much food we wouldn’t profit) which I imagine isn’t a good business practice. No matter what franchise you end up with, the chance of success grows exponentially when you have a great attorney representing you throughout the process. The ability to work through a franchise contract, with its hundreds of pages of legalese, is just one example where a great attorney can put you in a better position with those selling the franchise. I picture my attorney, Elliott Stapleton, sitting at a table across from the “corporate types” working out a great deal for me as I lean back in my chair and eat my favorite food (that I now own.) I’m sure my great-grandfather would be proud. I enjoy cooking dinner for my wife and daughter, and I yell “Bam!” with every ingredient I add. I cut up garlic (Bam!), onions (Bam! Sniff...), and sauté them in a little bit of olive oil (Bam!). The problem is that I was doing this way before I had heard of the chef named Emeril Lagasse. It turns out that Emeril also likes to dramatize each ingredient, but he was just smart enough to register his emphatic use of the word “Bam!” as a trademark. This was disappointing to me because I also like to yell “Bam!” during any sporting event I participate in, or when I put a tip in a tip jar, or when I give a police officer my driver’s license.

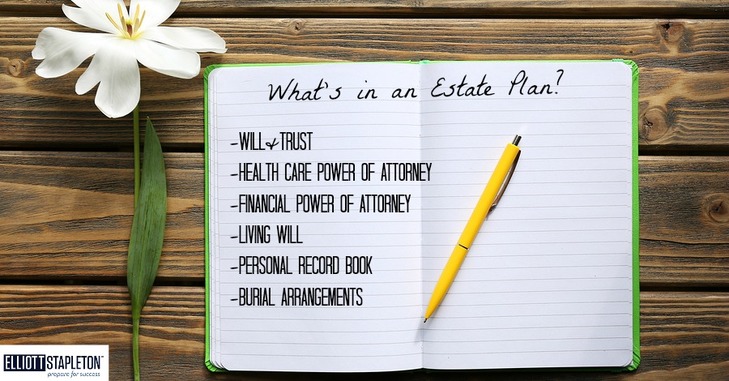

In fact, most of the previous statements I just made were untrue. They were meant to incite readers to think “seriously, how has he never heard of Emeril Lagasse’s “Bam!”? I would venture to guess that most people will recognize Emeril’s “Bam!” for many years to come, and this illustrates a key point; an effective trademark can sky rocket a business to the front of its competition by attaching a recognizable brand to a product or company. An effective federal registration can also prevent other businesses from confusing your customers, secure a nationwide monopoly in the name, and prevent others from misappropriating your company’s goodwill. So how does one go about obtaining a trademark? Obviously creating a catchy, recognizable trademark is the first step in a surprisingly complicated process. Let’s say presidential hopeful Donald Trump wants to register his immense, thinning comb-over hairdo as the “American Politician Haircut of Tomorrow”. After he successfully registered the phrase “You’re Fired” as a trademark, Donald Trump has realized the key to successfully protecting a trademark is effective federal registration of said trademark. While it is possible to register without the help of an attorney, the fact is your chances of successfully registering a trademark improve dramatically with an attorney involved. I very rarely use statistics to validate my claims (because sometimes just making things up is easier) but in this case the empirical data shows a significant increase in successful filings when a trademark attorney is involved. So if Donald Trump uses a trademark attorney to successfully register the name of his awful hairdo as a trademark, then people won’t be able to call their immense, thinning comb-over hairdos the “American Politician Haircut of Tomorrow.” For me the key to deciding how to proceed with this process was the cost/risk ratio. It costs hundreds of dollars of non-refundable money to file a trademark application. If an application is not filled-out impeccably, the application is thrown out and the money is lost. I think it is silly to risk repeated failed applications (at the risk of potentially losing hundreds of dollars of non-refundable filing fees) when a trademark attorney can use their wealth of knowledge to get it done right. That is why I walked into Elliott Stapleton’s office with my trademark idea and laid it on his desk with an emphatic “Bam!” If you have any questions on the information contained in this blog, see the business law website of Cincinnati attorney, Elliott Stapleton, with CMRS Law, 123 Boggs Lane, Cincinnati, Ohio 45246, or contact him at (513) 334-0099. I just saw a video of a man who received an entire face transplant from an anonymous organ donor. As a nurse I am familiar with skin being considered an organ, but it had not occurred to me that someone could be walking around with my face after I die. I asked my lawyer, Elliott Stapleton, if I could stipulate somewhere in my Estate Plan that only a person with a lot of muscles be given my face when I die so that my wife could finally see what that looks like. After the long silence Elliott decided we should review some of the other benefits of having an Estate Plan.

An Estate Plan is a plan that puts all of a person’s affairs in order should they pass away or become incapacitated. It draws a very specific map for the survivors to follow in regards to financial assets, medical decisions, beneficiary designation, and much more! Or in my case, my beneficiaries will receive an actual treasure map, whereby they must go on an Indiana Jones-style treasure hunt, with boulders and poison-tipped darts. One benefit of an Estate Plan is the ability to create a Will, which allows for designation of Beneficiaries and Guardians (the people who will take care of your children if you die.) I still have not heard back from Oprah Winfrey, which brings me to the point that the Guardian(s) you select should be aware and willing to take your children (which is why I sent Oprah a letter in the first place.) Another benefit to an Estate Plan is the ability to create a Trust. Putting your assets through probate court eats away at your money and delays payment to your beneficiaries by months and sometimes even years! A Trust allows you to avoid probate court, saving your estate lots of money and time. More importantly though, it designates a Trustee to distribute your assets according to your wishes. The Trustee cannot, however, stop the beneficiaries from throwing away your vintage “We Are the World” vinyl once it is left to them. You can also designate a Financial Power-of-Attorney to make any financial decisions if you become incapacitated. I’ve discussed this in a previous article, but in summary no one has ever asked me to be a Financial Power-of-Attorney because I aspire to someday have my own expensive Jim Henson-type creature lab. Another benefit of an Estate plan is the ability to create a Healthcare Power-of-Attorney. This names a person who will make all of the medical decisions if you are unable to do so. I tried to make my oldest brother my Healthcare Power-of-Attorney halfway through my 21st birthday party, but I’m pretty sure the bar napkin I wrote it on wouldn’t have stood up in court. Elliott explained that a Living Will can also be created to declare personal preferences on life support and other treatments. I declared that if I’m ever incapacitated, someone is to give me daily foot massages. Elliott said that this would be up to my family and close friends to carry out, but would not be enforceable by law. The final benefit of an Estate Plan I will discuss is the ability to create a Personal Record Book. As a humorist blogger and inventor, if I were to pass away I would want my wife to have access to all of my Good Ideas I’ve had over the years. With a Personal Record Book I can leave her my passwords and grant her access to things like my Facebook page, my blog, and my monthly subscription to Muscle magazine (which I don’t own yet.) Another added benefit of this part of the Estates Plan is that I am able to declare whether I want to be buried, cremated, or in my case have my ashes spread on the salad bar at Frisch’s that I love so much. I am in no way a controlling person, but the thought of having no control over things like my money, health, and Facebook page if I become incapacitated or die is terrifying to me. Even more terrifying than the thought of some other overweight person having my face. If you have any questions on the information contained in this blog, see the estate planning website of Cincinnati attorney, Elliott Stapleton, with CMRS Law, 123 Boggs Lane, Cincinnati, Ohio 45246, or contact him at (513) 334-0099. In order to run an efficient and successful LLC, it is imperative that a well-planned Operating Agreement be created. For example, an Operating Agreement sets up who runs the day-to-day business, and creates a system for resolution of internal disputes between members. I tried to have my two-year-old daughter sign an Operating Agreement to help us resolve conflicts but she’d rather just throw her bowl of milk and Cheerios on the ground._

By creating voting standards and/or a buyout option, an LLC can avoid judicial dissolution of the company when these disputes occur between members. Imagine having a company that creates a successful product, let’s say a t-shirt company, then suddenly one of the members only wants to make t-shirts without sleeves. An Operating Agreement would allow the members of the company to handle this dispute while keeping their company, and sleeves, intact. The other member could be bought out, and then take the money to Mississippi to start a very successful no sleeve t-shirt company, all without having to throw their bowl of Cheerios on the ground. A well-designed Operating Agreement can also handle the unfortunate situation of the death of a member. Let’s say a member of a company that makes trampolines and industrial ceiling fans dies suddenly for obvious reasons. This member’s family can be taken care of for all of that member’s hard work without having these same family members interfere with the business operations. Finally an Operating Agreement protects a business’s intellectual property. This includes trademarks, copyrights, and trade secrets. If a company is formed without an Operating Agreement, a member can try to claim the intellectual property as an individual asset, instead of an asset of the business. For example, if John Mayer’s band broke up without having an Operating Agreement in place, someone else in the band could claim that their body was a wonderland. If you didn’t get this joke, it was very funny. In other words, creating an effective Operating Agreement is really important for a new business. That is why I let Elliott Stapleton help me create mine. Now I just have to find investors to buy into my no sleeve t-shirt company idea. You may also enjoy reading Part 1 and Part 2 of the Starting a Business series. |

Elliott Stapleton Attorney with CMRS Law

|

Elliott Stapleton - Cincinnati Estate Planning Attorney | 123 Boggs Lane, 1st floor, Cincinnati, Ohio 45246 | Phone: 513-334-0099

THIS IS A LEGAL ADVERTISEMENT ONLY. GENERAL INFORMATION ONLY, NOT TO BE CONSTRUED AS LEGAL ADVICE. ALL LEGAL DECISIONS SHOULD BE ADDRESSED WITH LEGAL COUNSEL

© Copyright Elliott Stapleton, LLC. All rights reserved.

The content on this site is for information purposes only.

No one should rely on the internet, including this or any other website, for legal advice.

Communicating through this site does not create an attorney client relationship and your submission is not a confidential communication.

THIS IS A LEGAL ADVERTISEMENT ONLY. GENERAL INFORMATION ONLY, NOT TO BE CONSTRUED AS LEGAL ADVICE. ALL LEGAL DECISIONS SHOULD BE ADDRESSED WITH LEGAL COUNSEL

© Copyright Elliott Stapleton, LLC. All rights reserved.

The content on this site is for information purposes only.

No one should rely on the internet, including this or any other website, for legal advice.

Communicating through this site does not create an attorney client relationship and your submission is not a confidential communication.

RSS Feed

RSS Feed